The dream of owning a small business is deeply ingrained in many Americans. Beginning this adventure requires a clear roadmap. Here, we outline the essential first steps to take your business from concept to concrete operation.

Location

The first concrete step in bringing your business to life is securing a physical location. Whether it’s a retail store, an office, or a workshop, the right location can significantly impact your business’s success. Consider factors such as target market, accessibility, and cost. Once you’ve found the perfect spot, signing a lease makes it official. Understand the terms and negotiate if necessary to ensure they align with your business plans.

LLC or Corporation

Many small business owners opt for forming a Limited Liability Company (LLC) or a corporation due to the personal liability protection and potential tax benefits they offer. Registering your business with the state is a formal process that involves choosing a unique name, filing the necessary paperwork, and paying a filing fee. This step is crucial for legal recognition, opening bank accounts, and establishing credibility.

Tax ID

One of the most critical steps in establishing your small business is registering for a Tax Identification Number (TIN), also known as an Employer Identification Number (EIN). This federal tax ID is essential for several reasons, including hiring employees, opening a business bank account, and paying taxes. Obtaining an EIN is a straightforward process that can be done online through the IRS website.

Business License

Before opening your doors, you must obtain the necessary business licenses and permits. These vary greatly depending on your business type, location, and regulations at the local, state, and federal levels. Registering your business with the city ensures you’re recognized officially and legally allowed to operate. It’s essential to research which licenses and permits you need to avoid any legal issues down the line.

Special Permits and Professional Licensing

Depending on the nature of your business, you may require additional permits or professional licenses. This is especially true for businesses involved in health care, food service, and certain trades. These permits and licenses are designed to ensure that businesses meet specific standards for safety, health, and professionalism. Obtaining them is not just about compliance but also about building trust with your customers.

Fictitious Business Name

If you plan to conduct business under a name different from your own or the officially registered name of your LLC or corporation, you’ll need to file for a “Doing Business As” (DBA) name. This process allows you to operate your business under a trade name, providing flexibility and brand identity. Filing a DBA is typically done through your county clerk’s office or the state government, depending on where your business is located. For example, if you need to file a DBA in Orange County, California, you will need to do it with OC Clerk Recorder.

Business Bank Account

Opening a business bank account separates your personal assets from your business’s assets, simplifying accounting and tax processes. To open a business bank account, you’ll need your EIN, business formation documents, and ownership agreements. Choosing the right bank involves considering factors like fees, services offered, and the convenience of online and physical banking options. A business bank account also helps establish a clear financial history for your business, which can be beneficial for obtaining credit or investment in the future.

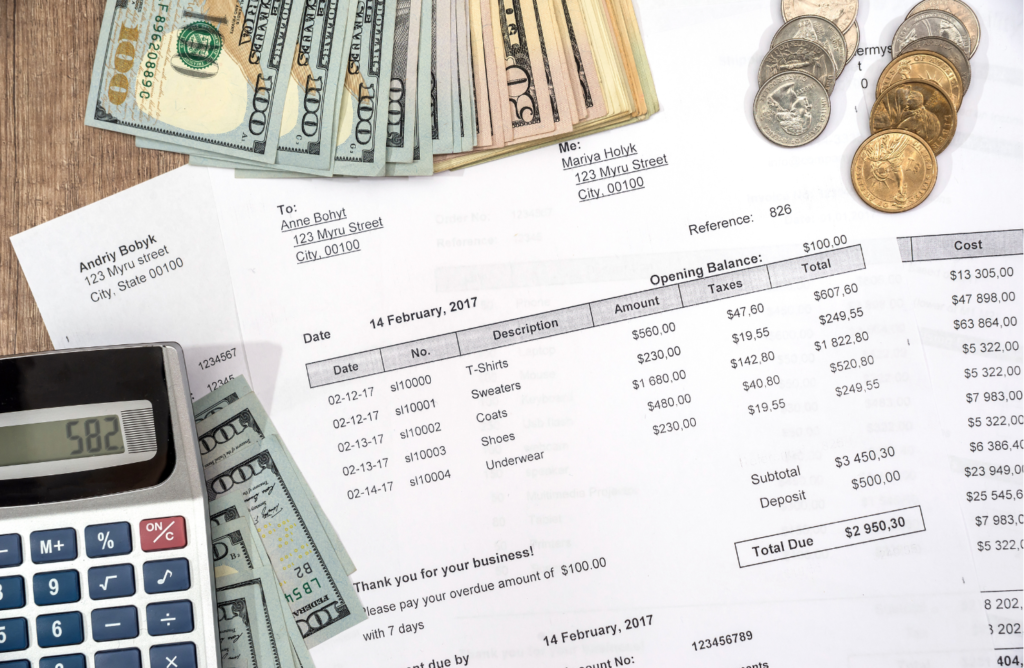

Merchant and Bookkeeping

Setting up a merchant services account allows you to accept credit and debit card payments from customers, expanding your payment options and potentially increasing sales. Additionally, choosing the right bookkeeping method is critical for tracking expenses, managing invoices, and preparing financial statements. Whether you decide to use software like QuickBooks, hire a professional accountant, or use a combination of both, ensuring accurate and up-to-date financial records is essential for making informed business decisions and preparing for tax season.

Payroll

If your business plans to hire employees, setting up a payroll system is a must. This system should account for withholding the correct amount of taxes, paying employees on time, and ensuring compliance with employment laws. Many small businesses opt for payroll software or services to streamline this process. These tools can help manage payroll taxes, year-end tax forms, and employee benefits with ease.

Following these crucial steps can make the journey of starting your business much smoother. However, even with instructions, small business owners can still be overwhelmed and make mistakes. If you need a business consultation or just a little more guidance on what to do next as a small business owner, feel free to give KYKY a call and we are happy to help. KYKY does not only provide you with insightful advice but also with high-quality, affordable business services.